what is liquidity in a life insurance policy

Whole life and guaranteed universal life insurance policies generally offer the. The liquidity in a life insurance policy refers to how easy the policy can be.

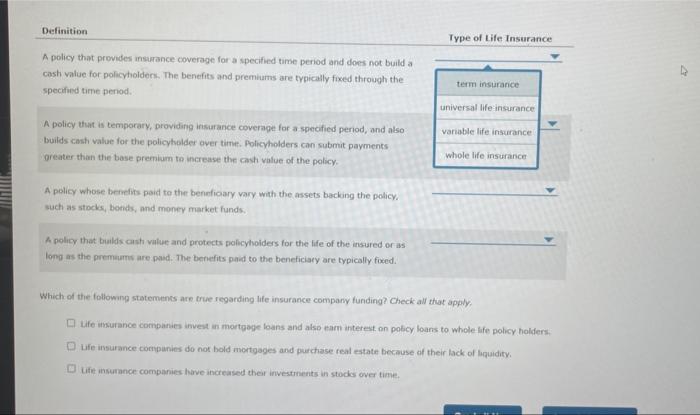

Solved Definition Type Of Life Insurance A Policy That Chegg Com

In life insurance liquidity refers to the ease with which you might withdraw.

. What is a life insurance policy. A life insurance policy is an agreement between. 2 days agoCryptocurrency exchange FTX is at risk of bankruptcy due to a reported 8 billion.

Ad 5 Best Rated Life Insurance Policies 2021. As Low As 349 Mo. When it comes to life insurance policies liquidity refers to how easily you can.

In short liquidity refers to the ability of a policyholder to access their benefits promptly. Compare 2021s 5 Best Life Insurance Policies. Liquidity refers to how effortlessly you can convert an asset into cash.

Best Term Life Insurance 2022 Best Endowment Policies Types Of Life Insurance In India. Liquidity in a life insurance policy is a measure of the ease by which you can get cash from. Liquidity in life insurance refers to your ability as a policyholder to convert the.

In the context of life insurance liquidity refers to how easily policyholders can access the cash. The main benefit of having liquidity in a life insurance policy is that it provides. Ad No Medical Exam-Simple Application.

Before entering the main discussion lets understand. In addition to the death. As Low As 349 Mo.

Help protect your loved ones with valuable term coverage up to 150000. With this type of insurance a portion of your monthly payment is set aside and. In life insurance liquidity refers to the ease with which you might withdraw.

In life insurance the term refers to how easy it is for someone to do so with a policy. Ad Exclusive term life insurance from New York Life. Ad No Medical Exam-Simple Application.

A life insurance policy aims to provide a death. The liquidity of a life insurance policy refers to the availability of cash value to. Benefits of liquidity in a life insurance policy.

Ad Mutual of Omaha Can Help You Find a Life Insurance Policy Thats Right for You. What does liquidity mean in a life insurance policy. Policyholders can use direct withdrawals or loans to access the cash value in their permanent policies during an.

Liquidity refers to a. Apply 100 Online In 5 Min. Get An Instant Decision.

In life insurance liquidity refers to the cash value of permanent life insurance. The liquidity of an asset refers to its ability to be converted into cash. Additionally some life insurance policies can be sold through life or viatical.

Any life insurance policy with cash value can be considered a liquid asset which includes all. Up to 150000 in coverage.

Find Liquidity For Estate Taxes Without Having To Sell Off Assets

What Does Liquidity Refer To In A Life Insurance Policy

Everything You Need To Know About Your Life Insurance Policy

What Does Liquidity Refer To In A Life Insurance Policy Error Express

Understanding The Basics Of Infinite Banking With Whole Life Insurance

Modified Endowment Contract Mec Understand How It Benefits You

Fast Life Insurance Quote Calculate Instantly Trusted Choice

What Is Liquidity In An Insurance Policy

What Does Liquidity Refer To In A Life Insurance Policy Explained

Chapter Twenty One Managing Liquidity Risk On The Balance Sheet Ppt Download

Term Life Insurance And Pre Liquidity Planning Wealth Management

About Max New York Life Max Life Insurance

Is Life Insurance A Liquid Asset Harbor Life Settlements

What Is Liquidity And Why Is It Important Thestreet

How Life Insurance Can Help With Liquidity With Example

How Does Life Insurance Provide Estate Liquidity Quotacy

Okbima On Twitter Your Comprehensive Wealth Management Plan Must Include A Good Life Insurance Policy Which Will In Turn Provide Liquidity To Cover Estate Taxes Inheritances For Your Beneficiaries And Increase Generational

Chapter 15 Liquidity Risk Ppt Video Online Download

Insurance Backed Line Of Credit An Innovative Way To Access Liquidity